If your normal routine involves things like going grocery shopping, filling up your gas tank, or even grabbing a coffee before work, you’ve undoubtedly felt the impact of the recent rise in inflation. Inflation makes everything more expensive, and as a result, it’s deterring many aspiring homeowners and potential buyers from making any kind of move right now.

It’s understandable, especially with interest rates on the rise. It can also be difficult to justify a major investment when raising the cash necessary for a down payment required by a conventional mortgage is increasingly difficult. And those who are self-employed or with credit scores lower than 620 have an even more challenging time securing loans, regardless of how much they earn.

But homeownership is a very smart move right now — if a buyer can purchase in a smart way. In fact, homes are a great asset for hedging against inflation, and with rental rates on the rise and the value of home equity higher than ever, purchasing now could help make your investment a much more profitable one than if you wait. The key is letting your clients and prospects know that there are a lot of great loan programs available to help them overcome the challenges of today’s market and secure a home that will pay off in the long run.

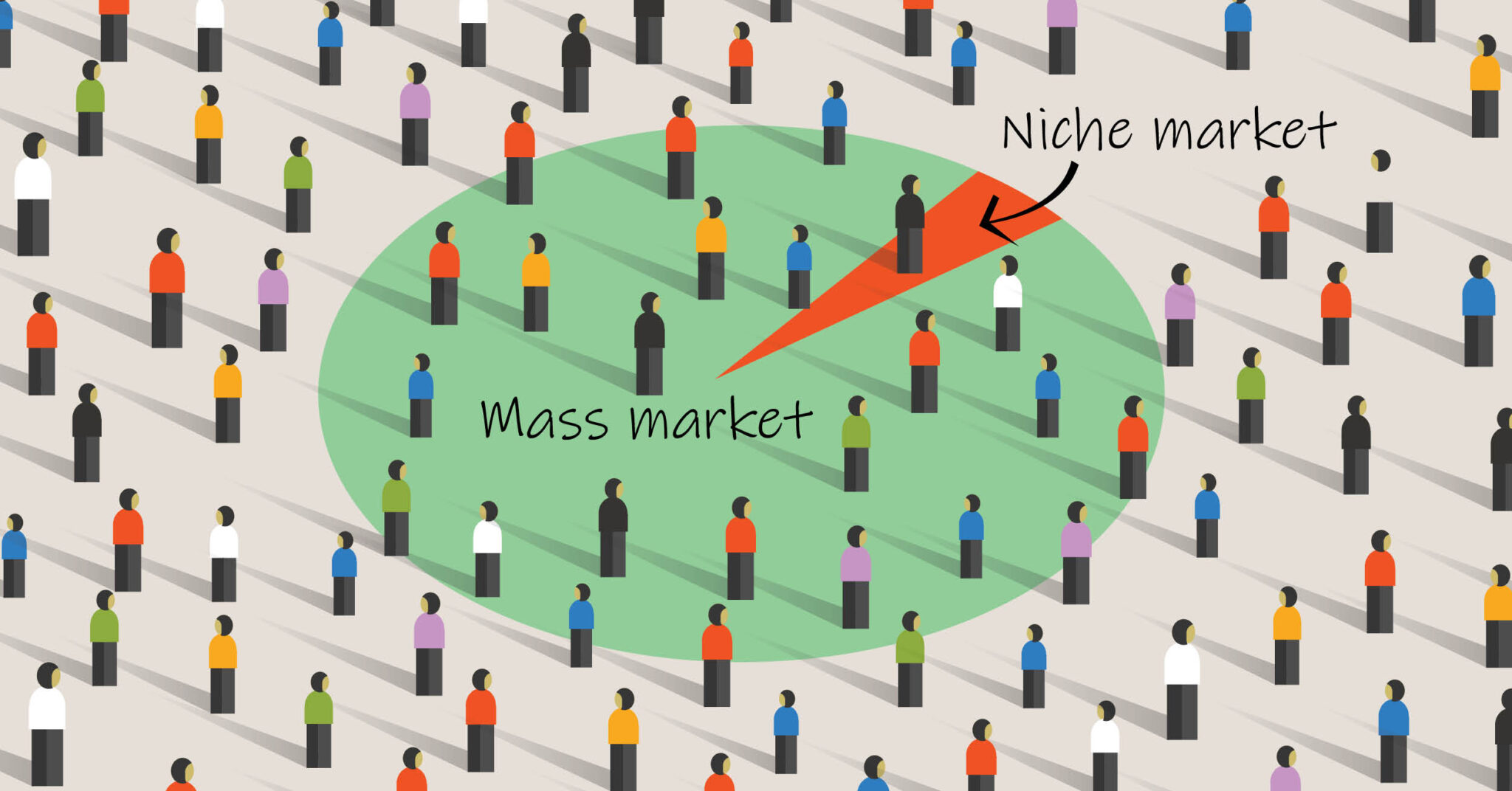

Check out a few of the niche mortgage solutions that AFR Wholesale® offers, which can help your clients achieve their financing goals by purchasing a home today instead of waiting.

Discounted Programs for Veterans

Serving the country comes with some high-value entitlements, not the least of which is the venerated VA loan program. Over 75 years, the program has secured more than 24 million loans for active and retired military personnel and protected them from excessive interest rates, loan fees, and substandard construction. Active-duty military personnel, reservists, veterans, and their eligible spouses may take advantage of VA loan options that offer up to 100% financing to purchase, renovate, build, or refinance real property.

From fully amortizing fixed loans that have no down payment requirement and stable monthly payments to help buyers combat rising costs and interest rates, to VA financing for Manufactured Homes that present a more affordable home option in a low inventory environment, you can help our veterans find a solution that gets them into a home they love today.

OTC Construction Loans

“We don’t pay for dirt” is probably the answer many prospective buyers receive when looking for a loan to purchase land on which to build. But unlike many other financial institutions, AFR offers a One-Time Close (OTC) Construction loan program that may be applied to manufactured, modular, and conventionally constructed housing. It allows borrowers to finance not only the construction of a home, but also the building site and its improvements with just one closing — reducing total closing costs. This simplified process particularly benefits first-time home buyers.

OTC construction loan offerings may be obtained through FHA, VA, USDA, and conventional financing. And AFR’s concierge-level service can guide you and your builder partner through the whole process, making it a win for everyone involved.

Non-QM Bank Statement Qualifying Loan

Lending institutions prize predictability, and especially in a climate like today’s, they want to know that the borrower has a steady source of income. Self-employed professionals may earn good money, but without guaranteed, predictable salaries, they need special financing options.

One such option is a Non-QM bank statement qualifying loan, which uses an analysis of bank deposits rather than traditional income documentation to determine risk. If the risk is within acceptable limits, other qualifying factors apply. Upon approval, the loan may be used to purchase a variety of property types.

To take advantage of this growing demographic, AFR is here to help.

Manufactured Housing Loans

The term “manufactured housing” encompasses mobile homes, manufactured homes, and modular homes. But each of these homes offer unique benefits to buyers — especially first-timers. From costing a fraction of the average cost of a site-built single-family home to design flexibility, energy efficiency, and more, it’s no surprise that more first-time buyers or downsizers are going this route. And with AFR, you can also offer them some of the most competitive rates in the country.

AFR offers a comprehensive selection of manufactured housing financing options, including FHA, VA, USDA, conventional and programs like MH Advantage®, and CHOICEHome®. These options enable you to match your clients to the most advantageous financing options for these increasingly popular and more affordable home options.

Today’s volatile economy, unique real estate market, and shifting employment scenarios demand flexibility in mortgage financing. You can offer clients both security and flexibility through AFR’s extensive suite of niche loans and resources. There’s no better time to find the mortgage solution that fits your clients’ needs. Contact us today.