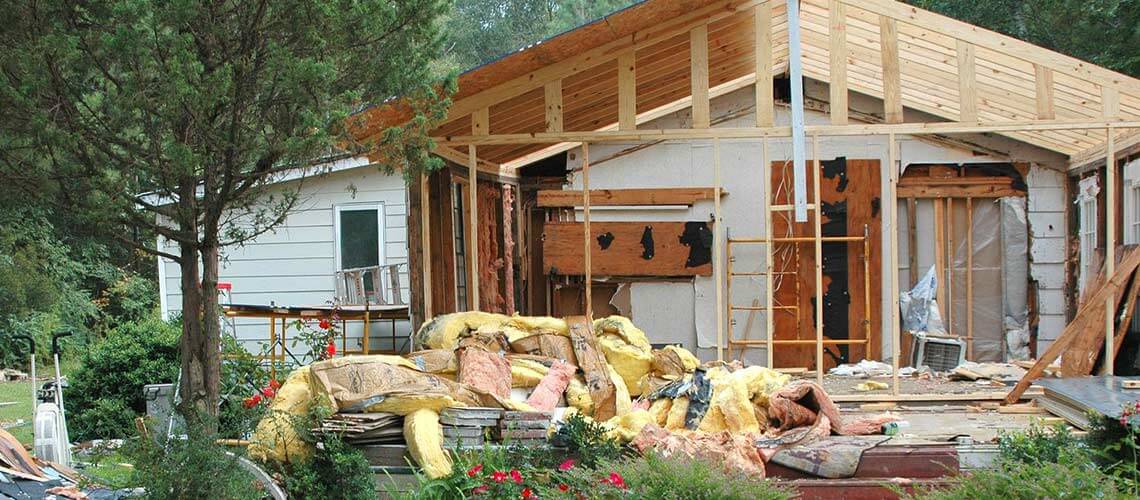

In the aftermath of the severe storms and flooding in Louisiana, the U.S. Department of Housing and Urban Development (HUD) recently announced that it will provide support to homeowners and low-income renters who were displaced from their homes. The official announcement came August 17, five days after the severe weather began. The widespread flooding has been called “the worst US natural disaster since Hurricane Sandy in 2012,” with 13 deaths reported so far as a result of the flooding. Among the survivors, many are without safe, dry places to live and have been forced to leave their homes.

That same week, President Obama issued a disaster declaration across 20 Louisiana parishes, making it possible for HUD Secretary Julian Castro to officially offer foreclosure relief and other assistance to certain families living in the affected areas.

“Families who may have been forced from their homes need to know that help is available to begin the rebuilding process,” stated Castro. “Whether it’s foreclosure relief for FHA-insured families or helping these counties to recover, HUD stands ready to help in any way we can.”

According to an official press release from HUD, the Department is offering six key systems of support. These include:

- Granting immediate foreclosure relief – HUD granted a 90-day moratorium on foreclosures and forbearance on foreclosures of Federal Housing Administration (FHA)-insured home mortgages.

- Assisting the State of Louisiana and local governments in re-allocating existing federal resources toward disaster relief. HUD’s Community Development Block Grant (CDBG) and HOME programs give the State and communities the ability to redirect millions of dollars in funding to address critical needs. These can include housing and services for disaster victims.

- Making insurance available for both mortgages and home rehabilitation – The Section 203(k) loan program helps those who have lost their homes finance the purchase or refinance of a home as well as its repair through a single mortgage.

- Making mortgage insurance available – HUD’s Section 203(h) program provides FHA insurance to disaster victims who’ve lost their homes and are facing the task of rebuilding or buying another home. Section 203(h) borrowers working with participating FHA-approved lenders are eligible for 100 percent financing, including closing costs.

- Offering Section 108 loan guarantee assistance – HUD will also offer state and local governments federally backed loans for housing rehabilitation, economic development and repair of public infrastructure.

Sharing information on housing providers and HUD programs – HUD will furnish information with FEMA and the State government on housing options that may have available units in the affected areas. This includes Public Housing Agencies and Multi-Family owners. The Department will also connect FEMA and the State government with subject matter experts to provide information on HUD programs and available residences.

Photography by [Oscar Williams] © 123RF.com

Subscribe To Our Newsletter

Sign up with your email address to receive news and updates.